1. Evaluate

- Getting to know you.

- Understanding your current situation.

- In-depth analysis of your financial goals.

- Establishing a time horizon for your retirement goals and needs.

- Evaluating your risk tolerance.

2. Analyze and Plan

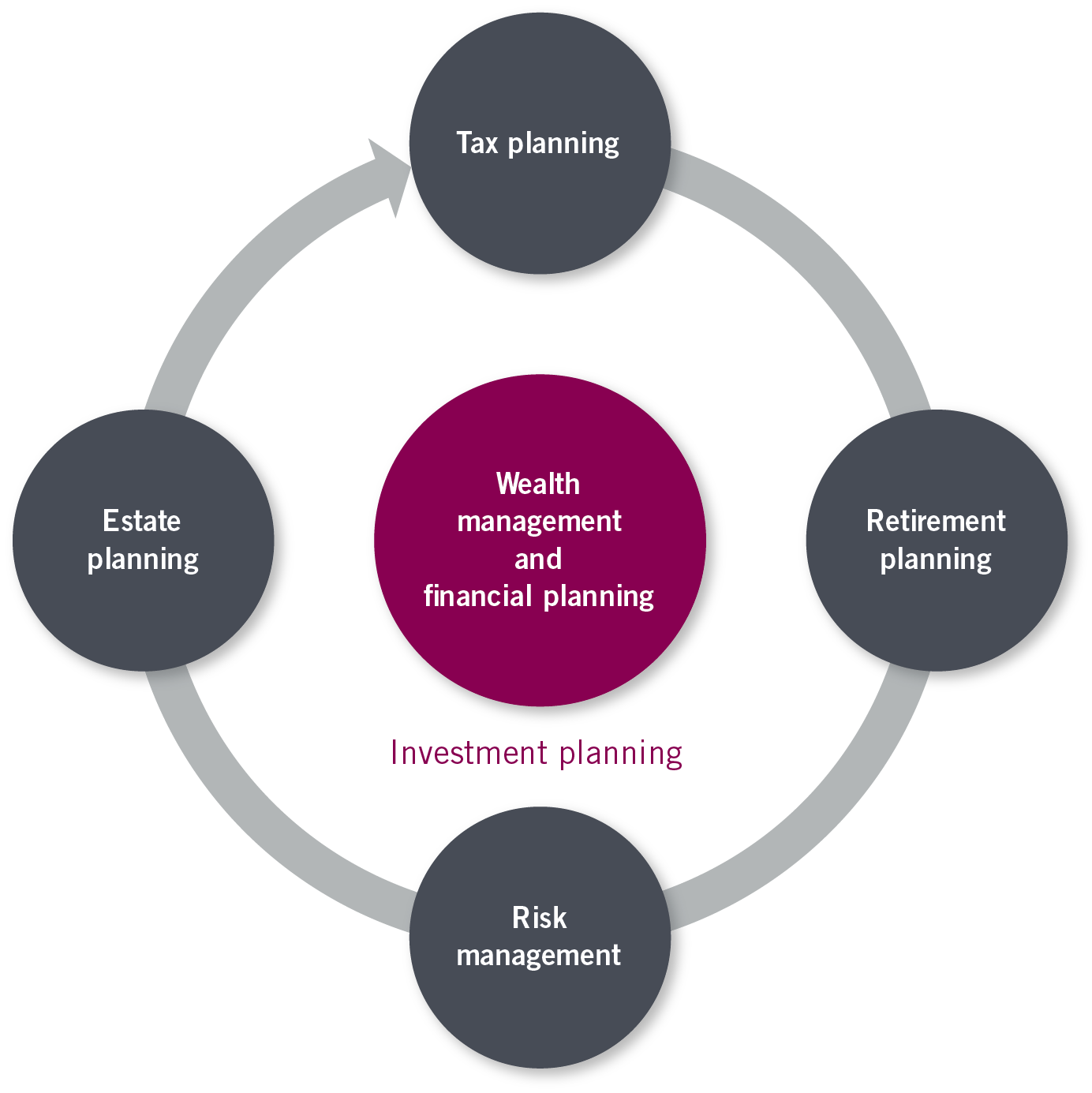

- Income tax analysis leading to its reduction and optimization during your hard-working and retirement years, allowing cashflow improvement.

- Current investment analysis to establish the optimum and most tax efficient asset allocation protecting your patrimony from inflation and helping you achieve your financial goals.

- Retirement goal analysis and building the proper plan allowing its implementation in the most tax efficient way.

- Estate analysis and building a tailored plan protecting it from all hidden and unknown taxes.

- Presenting you with a personalized financial plan tailored to your goals and needs.

3. Implement

Executing our comprehensive plan through the appropriate strategies:

- Tax optimization and reduction.

- Strategic and tax efficient investment allocation.

- Debt reduction and cashflow enhancement.

- Insurance solutions and risk management.

- Business succession.

- Estate protection (wills, mandates and trusts)

- Charitable giving.

4. Monitor

- Ongoing servicing.

- Regular review meetings.

- Portfolio monitoring and rebalancing.

- Addressing evolving goals